Transitioning into retirement is a journey unlike any other

It’s not just about moving from the phase of accumulating wealth to distributing it; it’s about navigating this shift without a steady paycheck, all while managing the unknowns of how long you’ll live and potential unexpected expenses. These risks, if not adequately addressed, have the potential to significantly disrupt your retirement dreams.

30 Years to build, is it ready?

Imagine dedicating the last 30 years to building your nest egg, only to face the possibility of rebuilding your assets or adjusting to a lower standard of living because of an improper transition into retirement.

The thought alone can be daunting.

After all, the stakes are high, and the margin for error is slim. Ignoring these risks can significantly impact your retirement lifestyle and peace of mind.

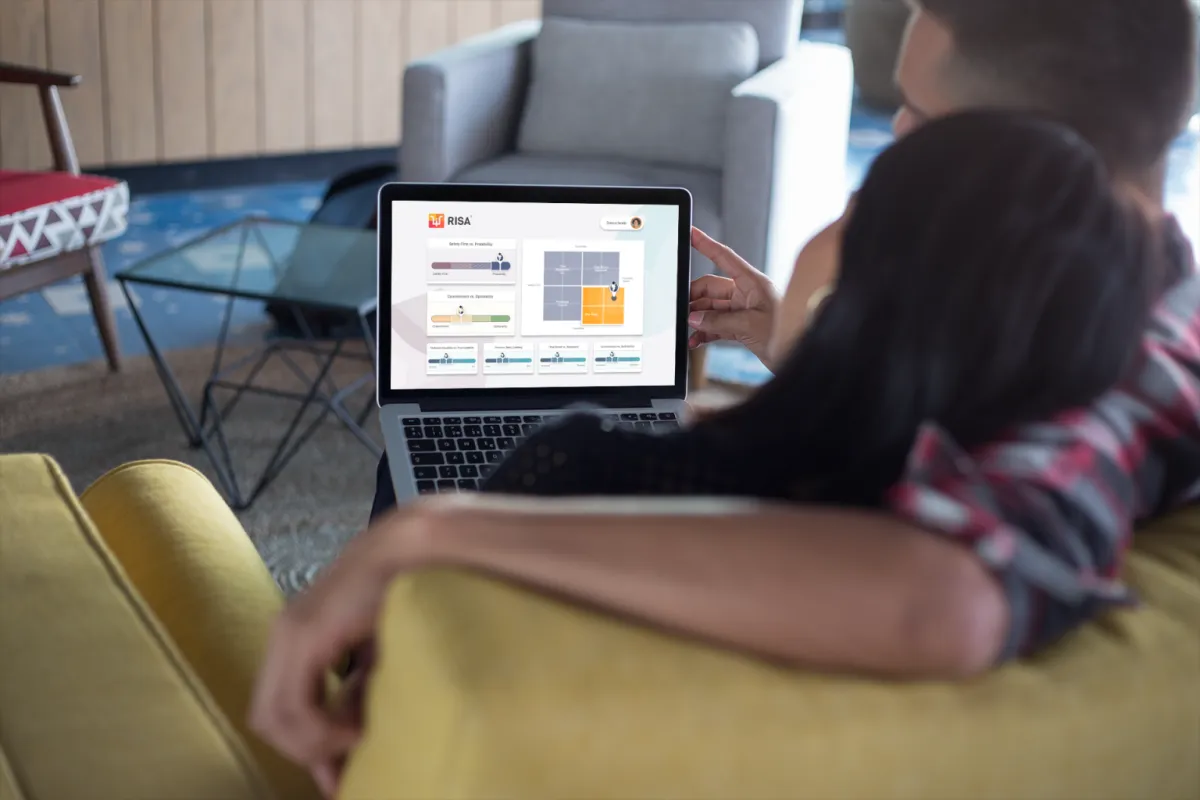

Introducing Your Personal Retirement Guide: The RISA®

This is where identifying your retirement income style comes into play. Knowing your style will help you navigate these new retirement risks because it will lead to strategies that complement your style and preference.

It’s about creating a strategy aligning with how you envision sourcing your retirement paycheck. Think of it as custom tailoring your retirement plan to fit your life perfectly.

Learn Your Style to Learn How to Navigate

With RISA®, the transition into retirement no longer feels like bracing for impact. Instead, it becomes an opportunity to step into your next phase of life with confidence and enthusiasm. Picture this: instead of dreading what might go wrong, you’re excited about what will go right. You feel prepared, knowing that your retirement strategy has been crafted to suit your unique style and preferences.

You move from fearing those “what if” scenarios that used to keep you up at night to resting easy, knowing you have a solid plan that can adapt as needed. And it’s not just about you. With a strategy that accounts for both you and your spouse’s styles, you’re assured that should anything happen, your plan remains robust and actionable.

Here’s a real-life transformation:

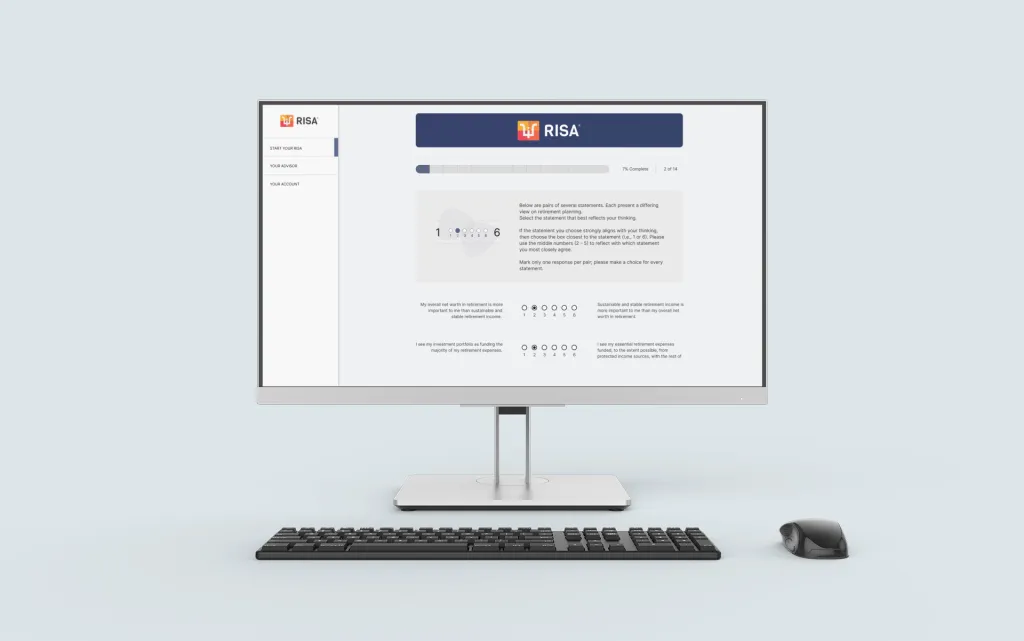

Before RISA®: many felt overwhelmed by the complexity of retirement planning, uncertain if their financial decisions were leading them in the right direction.

After RISA®: they found clarity and certainty. They knew exactly how their retirement income would be generated, and they had an adaptable, resilient plan tailored specifically to their needs and goals.

For Everyone Nearing or in Retirement

By taking the RISA® assessment, you’re not just choosing a retirement plan. You’re choosing confidence, fulfillment, and a readiness for whatever lies ahead. You ensure that pesky “what if” scenarios don’t stand a chance against your well-laid plans.

And most importantly, you’re providing a contingency for your spouse, securing peace of mind for both of you.

Waiting and hoping isn't a strategy

It’s time to take control of your retirement journey. Click on the link now to start your RISA® assessment. Upon completion, you’ll be directed to a next steps page where we can schedule a complimentary meeting to interpret your RISA® Profile and discuss how to implement your personalized retirement income strategy.

Ready to Redefine Your Retirement?

Your retirement journey is unique, and so are you. Let RISA® guide you to a retirement

filled with confidence, fulfillment, and peace of mind. Start today, and step boldly into your

next chapter.