Welcome to HomeStretch Financial

We Create Certainty for Your Retirement

A New Way to Help You Achieve Financial Freedom and Live The Life You've Always Dreamed

Welcome to HomeStretch Financial

A New Way to Help You Achieve Financial Freedom and Live The Life You've Always Dreamed

Liberate Your Lifestyle

Health Wealth Harmony

Serenity Now, Security Forever

Personalized Retirement Strategies

Expert Guidance at Every Step

Building Wealth for Tomorrow

Are You Income Planning or Income Guessing?

The best time to plant a tree was 20 years ago. The second best time is now!

~Chinese Proverb

Did you know you can create or buy your own pension and have more flexibility and better benefits then the old traditional ones?

There are financial products that allow you to plan with mathematical certainty and contractual guarantees. These products can provide an income you can NEVER outlive.

Learn how you can create your financial freedom day.

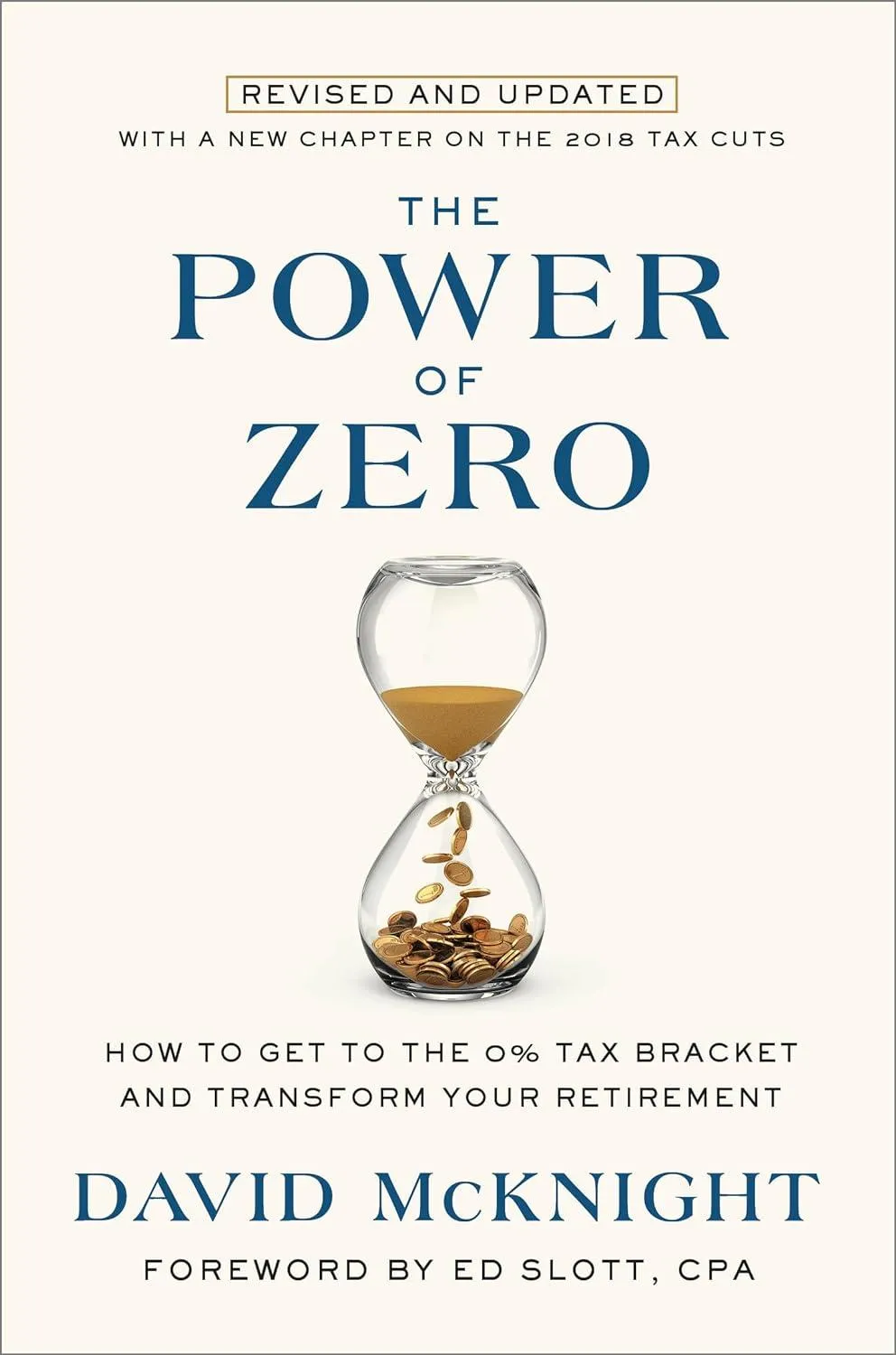

" You now have math and certainty in your corner when it comes to making a critical tax payment decision that may well determine how long your money lasts in retirement."

-David McKnight, author of The Power of Zero

Maximize Your Financial Potential with HomeStretch Financial

Unlock a future of stability and growth with tailored tax strategies, robust investment protection, and personalized financial planning.

Phase 1: Tax Planning "Strategize to Minimize"

Ensure more of your wealth stays in your pocket. Our Tax Planning phase focuses on creating tax-efficient strategies that preserve your assets and minimize liabilities, so you can maximize your retirement savings.

Phase 2: Income Planning "Secure Your Financial Future"

Reliability is key. Our Income Planning phase ensures a steady inflation-protected income stream for life, addressing the biggest concern of baby boomers- running out of money.

Phase 3: Protection Planning "Shield Your Legacy"

Safeguard what matters most. Our Protection Planning phase secures your assets from unexpected events, ensuring your financial security and peace of mind throughout retirement.

Phase 4: Risk Planning "Navigate with Confidence"

Mitigate risks and secure your investments. Our Risk Planning phase identifies and manages potential financial threats, aligning your portfolio with your long-term goals.

Phase 1: Tax Planning "Strategize to Minimize"

Ensure more of your wealth stays in your pocket. Our Tax Planning phase focuses on creating tax-efficient strategies that preserve your assets and minimize liabilities, so you can maximize your retirement savings.

Phase 2: Income Planning "Secure Your Financial Future"

Reliability is key. Our Income Planning phase ensures a steady inflation-protected income stream for life, addressing the biggest concern of baby boomers- running out of money.

Phase 3: Protection Planning "Shield Your Legacy"

Safeguard what matters most. Our Protection Planning phase secures your assets from unexpected events, ensuring your financial security and peace of mind throughout retirement.

Phase 4: Risk Planning "Navigate with Confidence"

Mitigate risks and secure your investments. Our Risk Planning phase identifies and manages potential financial threats, aligning your portfolio with your long-term goals.

Ready to get started?

Crafting Your Holistic Pathway to a Secure Future.

Our team, distinguished as a comprehensive, integrated, holistic retirement plan team, brings together diverse expertise from across the financial spectrum to tailor solutions that are as unique as your retirement dreams.

By coordinating all facets of your financial life, from investments to estate planning, we ensure a unified strategy that not only meets today's needs but also secures your tomorrow.

Trust us to navigate you through every financial season.

-Your Financial Freedom Team

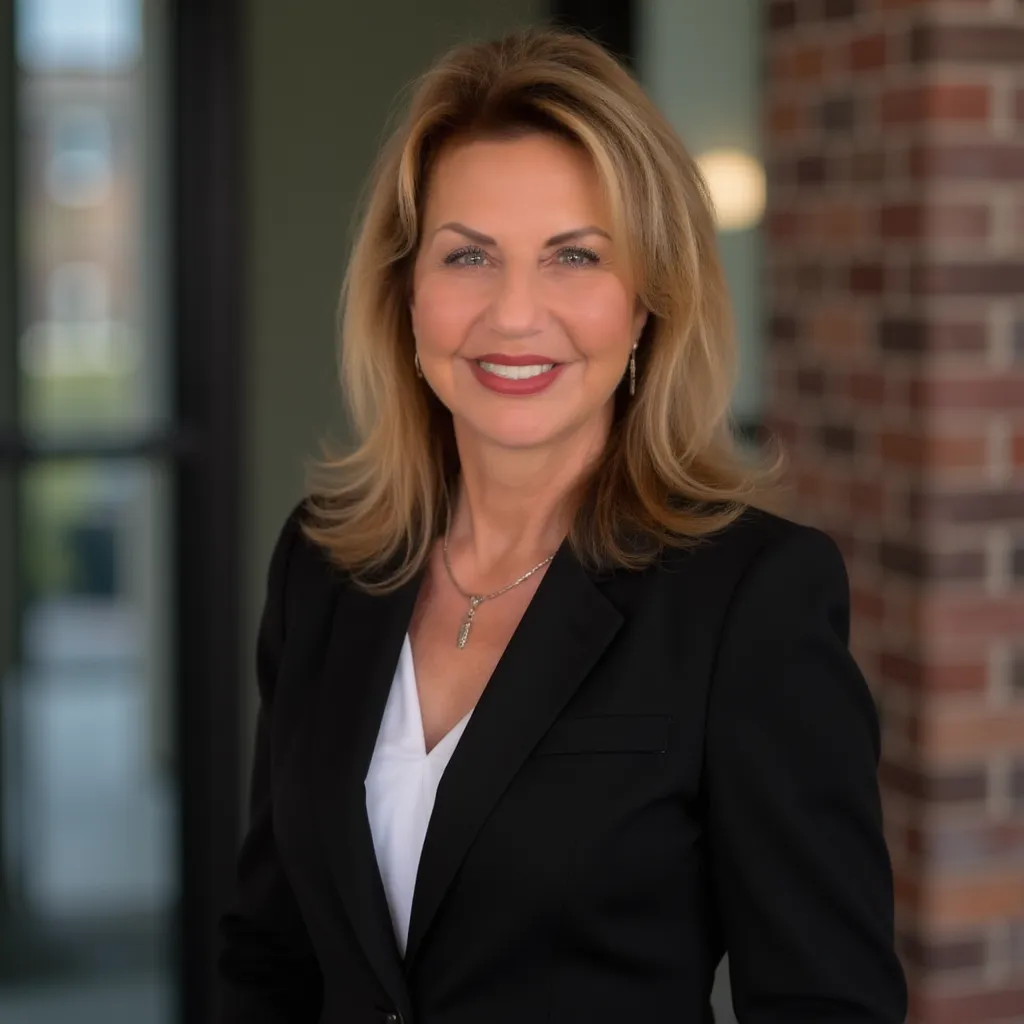

Jeff Snyder

Judi Snyder

As Seen On:

Brace for Impact

The Looming Tax Crisis That Could Derail Your Retirement

The Power Of Zero

Comprehensive, integrated, and holistic plan put together by a team of experts.

At Homestretch Financial, the Power of Zero is more than just a strategy—it’s the foundation of our approach to securing your financial future.

This comprehensive framework is designed to minimize tax liabilities and optimize your retirement plan, ensuring that every aspect of your financial life is aligned for maximum security and growth.

Under this powerful umbrella, we guide you through the essential phases of Tax Planning, Income Planning, Protection Planning, and Risk Planning, providing a holistic and personalized roadmap to a worry-free retirement.

The Power of Zero: The Tax Train Is Coming is the first major Hollywood documentary film to take an in-depth look at how the U.S. National Debt is setting the stage for massive tax increases within the next 10 years and how they’ll impact a retiring generation of Baby Boomers.

HomeStretch Financial Event Calendar

The Changing World of Retirement Planning® Webinar Series with Special Guest:

Mortellaro Law

Tuesday March 25th at 7:30 P.M. ET

THE MUST-ATTEND RETIREMENT EDUCATION COURSE

The Changing World of Retirement Planning®

April 10th & 17th

or Accelerated 1-Day Classes

April 12th or April 19th

at St. Petersburg College

The Challenging World of Retirement Planning Class

February 6th & 11th, 2025

Call for Information

The Challenging World of Retirement Planning Class

February 8th, 2025

Call for Information

Mitigating Marketing Loss Webinar

February 18th, 2025

Long Term Care Planning Webinar

March 18th, 2025

The Challenging World of Retirement Planning Class

April 3rd & 8th, 2025

Call for Information

The Challenging World of Retirement Planning Class

April 3rd & 8th, 2025

Call for Information

The Challenging World of Retirement Planning Class

April 10th & 15th, 2025

Call for Information

Tax Rate Risk Webinar

April 22nd, 2025

Dedicated To Our Clients Success

Join us on our blog as we explore the path to achieving a tax-free retirement. Our expert insights and strategies are designed to help you maximize your financial freedom, so you can enjoy the retirement you've always dreamed of without the burden of taxes.

The Journey From “I Should” to “I Choose”

Discover why retirement can feel unfulfilling and learn how to shift from a life of "should" to one of "choose." This post offers steps to reconnect with your true desires, find purpose, and embrace a... ...more

Retirement Planning

March 01, 2025•8 min read

Is Your Money Your Honey?

Discover how finding the right investment is like choosing the perfect relationship. Learn how aligning your values, goals, and money rules leads to a balanced, anxiety-free investment portfolio. ...more

Financial Advice

February 01, 2025•6 min read

It’s About More Than The Money…Gimme Five!

Discover the five key elements of a fulfilling retirement: spirituality, purpose, health, social connections, and money. Plan beyond finances for a joyful and secure second act of life. ...more

Retirement Planning

January 01, 2025•7 min read

FAQS

What is the benefit of working with a financial advisor?

Working with a financial advisor offers numerous benefits. First and foremost, advisors provide expertise and guidance tailored to your unique financial situation and goals. They can help you create a comprehensive financial plan, optimize your investments, minimize taxes, and ensure you're on track to achieve your financial objectives. Additionally, advisors offer peace of mind, knowing that you have a professional managing your financial affairs and helping you make informed decisions.

How do I choose the right financial advisor for my needs?

Choosing the right financial advisor is a critical decision. Start by assessing your own financial goals and preferences. Look for advisors with the appropriate qualifications and certifications, such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA). Consider their experience, specialization, and track record. It's also important to have a consultation or interview to ensure their approach aligns with your values and objectives. Lastly, check for transparency in fees and compensation to avoid surprises.

Do I need a large portfolio to benefit from financial advisor services?

No, you don't need a large portfolio to benefit from financial advisor services. Financial advisors can assist individuals at various stages of their financial journey, from those just starting to save to those with substantial assets. Advisors can help you create a financial plan, manage debt, set up an emergency fund, and make the most of your resources, regardless of your current wealth. Their goal is to help you improve your financial well-being and work towards your financial goals, whatever they may be.

© 2025 HomeStretch Financial